Invoices are a part of our everyday life. Every purchase we make generates an invoice. Whether we go to a grocery shop, a retail outlet, or even for a medical checkup, we are given an invoice when we pay for the product/service. Invoices are proof of the transaction bearing the transaction details such as date, time, total bill, the amount paid, amount received, etc. In this article, we will take a closer look at what is an invoice and how to create one.

Part 1: What is an Invoice?

An invoice is a document that records and itemizes transactions between a buyer and a seller. It includes transaction details such as time, date, seller name, products/service purchased, total amount, and any other important details relevant to the transaction. It is also known as a “sales invoice”.

An invoice is typically generated by the seller at the time of purchase or when the product/service is delivered. Invoices leave a paper trail and serve as proof of payment or the transaction itself.

Part 2: History of Invoice

Invoices have always been an integral part of the traditional booking and modern accounting software. Invoicing dates back to 7000 years ago in Mesopotamia where vendors and traders maintained written documents to record sales and purchases. Of course, accounting methods and invoicing systems evolved over the years and in the 16th century when invoices received their name.

The word invoice originates from the French word “envoys” or “envois” meaning mail or as the act of sending something. Since then, the term “invoices” was introduced for a purchase receipt.

Nowadays, there is an invoice for everything! Let’s see why we use them.

Part 3: Why do We Use Invoices?

Invoices are used for many purposes but they are mainly used to record a transaction. Businesses use invoices to track the amount receivable from the customer. This also helps them monitor total cash flow from sales. Moreover, invoices also serve as transaction proof and allow businesses to receive full payment on time. They also act as a sales record to track:

- The date of sale

- The time of sale

- The total amount charged to the customer

- Amount paid by the customer

- Amount outstanding

Part 4: What is an Invoice Not?

There are many documents that may look like an invoice but they are not.

1. Purchase Order

A lot of people mix invoices with purchase orders but they are both different financial documents. The purchase order is generated by customers to vendors for goods or services. It is sent before an invoice is even created. Upon receiving the purchase order, the vendor prepares the order and generates an invoice for the customer.

2. Bill

Bills collect immediate payments while that is not the case for invoices. While invoices are a type of bill, they are not always a bill. For example, when you eat at a restaurant, you cannot leave without paying the bill. But, if you sign up for a monthly gym membership, you can pay after a month or on a bi-monthly/quarterly basis and the invoice is generated accordingly.

3. Receipt

A receipt acknowledges that the order has been paid for. It does not enforce the terms of payment.

Part 5: What is on an Invoice?

Every invoice includes the following components:

1. Invoice Number

Every invoice is marked with a unique number. They keep a track of sales and present evidence of all sale transactions.

2. Date

Every invoice contains the date of purchase, date of invoice (the date invoice is generated), and date of payment.

3. Name and Address

The invoice includes the names of the buyer and seller (company/business/vendor) along with the postal address of each.

4. Description of Goods/Service

This is an itemized list of what you are charging for. Each product or service should be clearly mentioned along with the product number (barcode) and quantity (amount of the product/service purchased).

5. Amount

All line items are summed up at the bottom with “total amount”. The total amount includes the price of the good/service plus any applicable taxes.

6. Terms of Payment

These are the payment conditions the customers have to abide by. They are presented as “Net 14” or “Net 30” meaning the customer has 14 days or 30 days to pay, respectively.

Part 6: Types of Invoices

There are many different types of invoices depending upon the purpose. Here are the most common types of invoices:

1. Pro Forma Invoice

A pro forma invoice is generated before the product or service is delivered to the customer. These invoices inform customers about the scope and cost of the expected order. Pro forma invoices tell the customers how much they will pay once the order is delivered. The payment terms of the pro forma invoice may be adjusted at any time before the delivery.

2. Past Due Invoice

As the name suggests, this is an unpaid invoice that passes its due date. When an invoice is past due, it means your customer or client has not paid you within the agreed payment terms. This invoice is generated to remind the customer to pay stating new payment terms.

3. Interim Invoice

Interim invoices are generated to bill a large project across multiple stages/payments. These invoices are sent to customers as the project progresses. They allow businesses to manage cash flow throughout a long-term project.

4. Credit Invoice

A credit invoice is to refund or offer a discount to a customer. This invoice includes the negative amount to cover the cost of the amount returned to the customer.

5. Recurring Invoice

Recurring invoices collect recurring payments. They are billed for an ongoing project. For example, an agency might issue recurring invoices to a customer every month for continuous services that are provided.

6. Debit Invoice

A debit invoice is generated when a business increases the amount a customer has to pay for a product/service.

7. Commercial Invoice

A commercial invoice is for internationally exported goods. These invoices calculate tariffs and include the name, address, and phone number of buyer and seller, names and quantity of exported goods, and the country of origin.

Part 7: How to Create an Invoice

Follow these guidelines to create an invoice:

1. Credentials

An invoice must be generated by the seller after the purchase. It should serve as a request for payment with confirmed payment terms clearly mentioned.

2. Add All Components

To create an invoice, you have to make sure to add all the necessary components of an invoice like name, time, date, items, total amount, etc.

3. Choose Medium

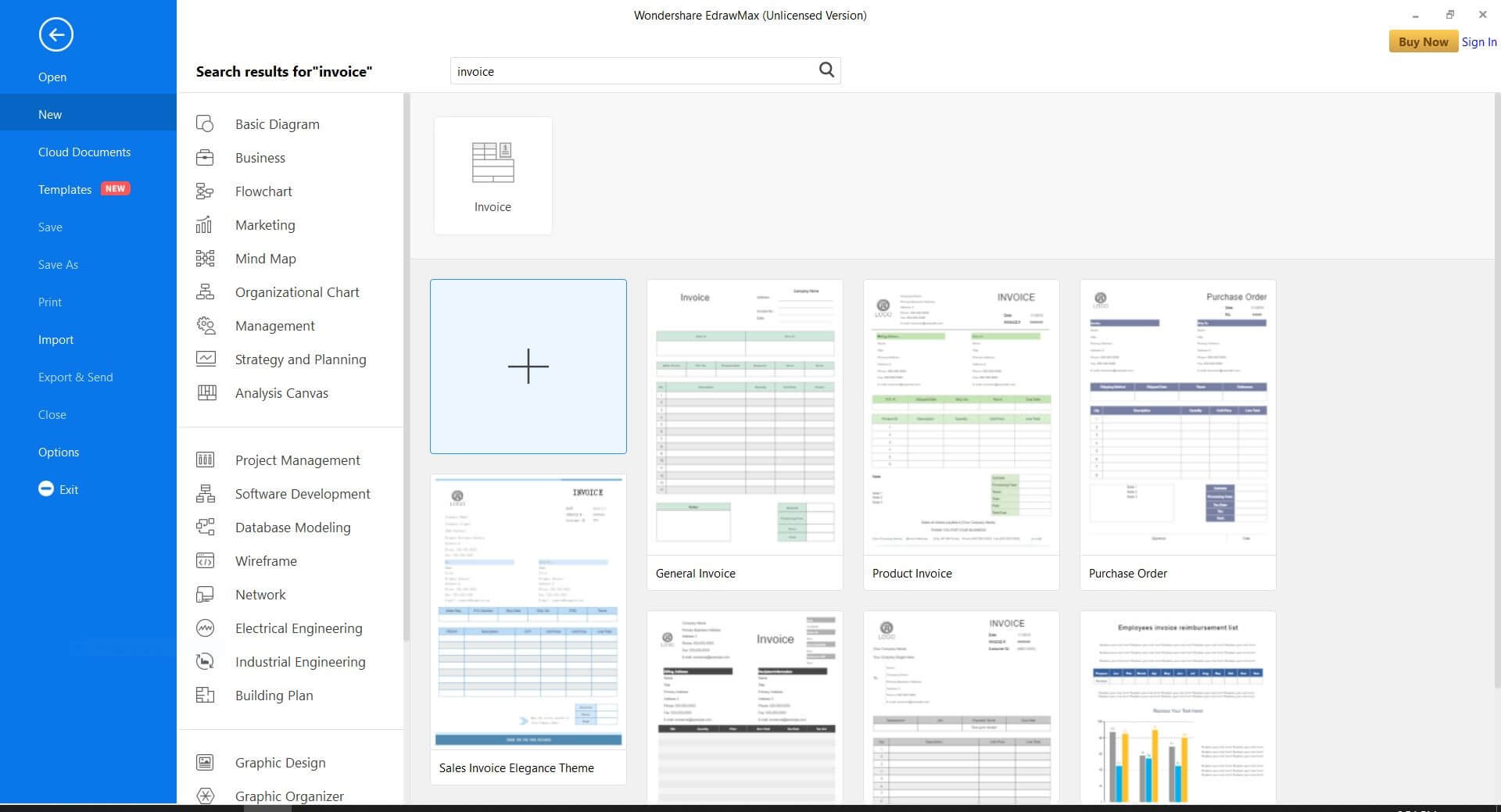

Invoices can be both in hard and soft copy. Many small businesses use paper invoices. However, filling physical invoices can be more time and effort-consuming. They are also more susceptible to errors and omissions. Nowadays, there are many softwares like EdrawMax that allow you to create invoices using customizable templates – quick, easy, and convenient. You can either forward them as a soft copy or download and print them.

EdrawMax

All-in-One Diagram Software

- Superior file compatibility: Import and export drawings to various file formats, such as Visio

- Cross-platform supported (Windows, Mac, Linux, Web, Android, iOS)

Part 8: Examples of Invoices

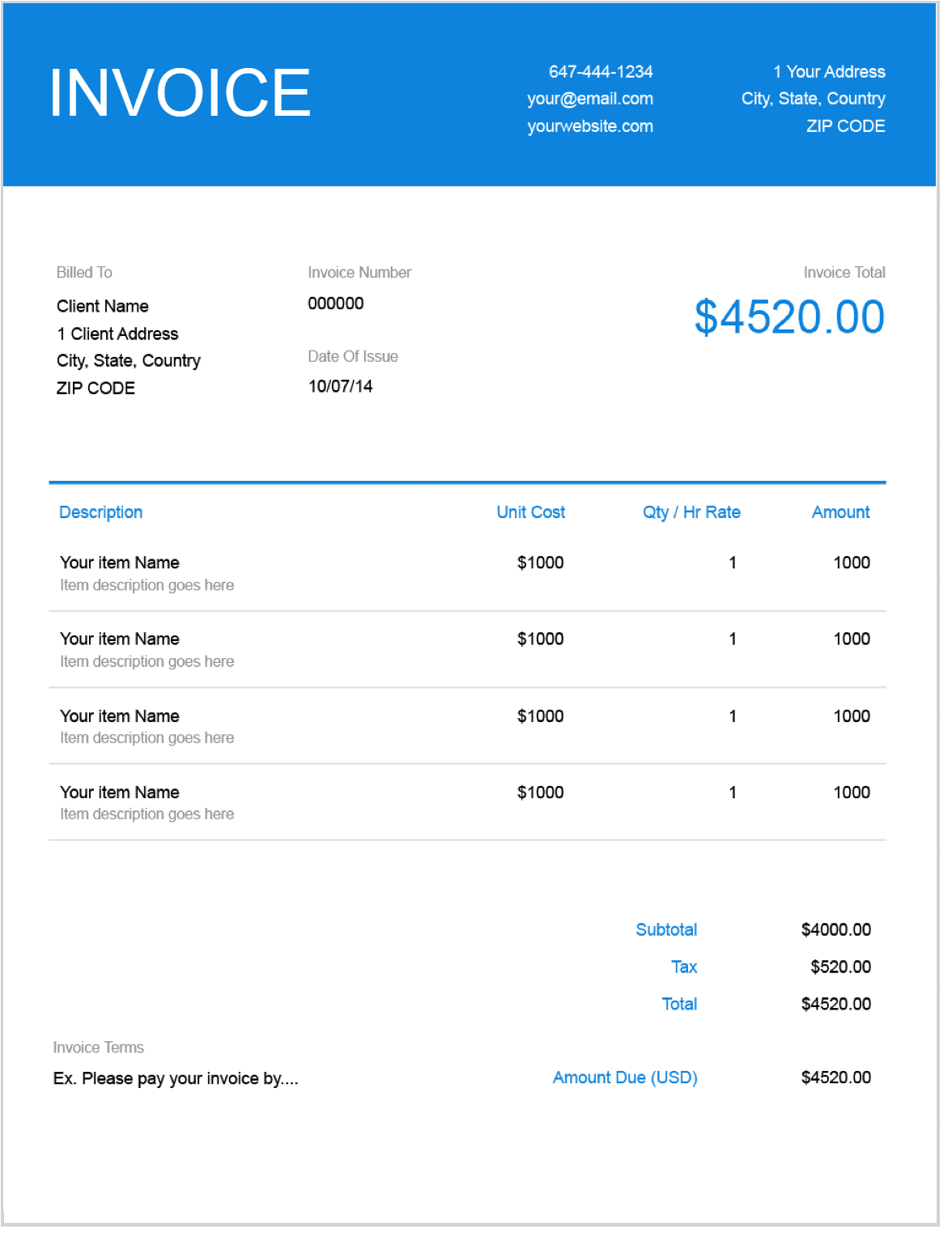

Example 1

This is an invoice template from EdrawMax. You can edit and customize. Moreover, they can also be shared online or saved in multiple file formats. You can download them and print them as well.

Example 2

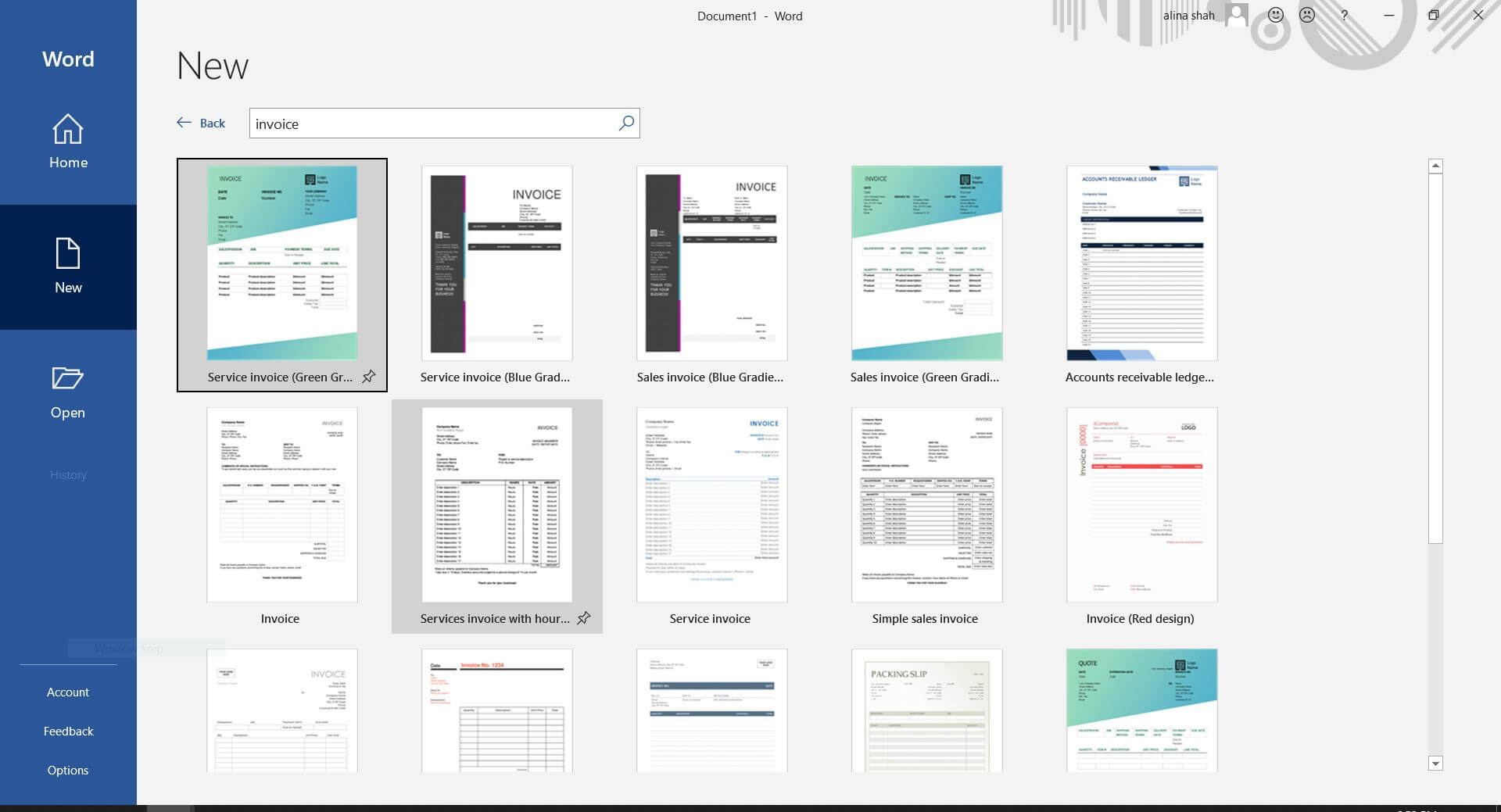

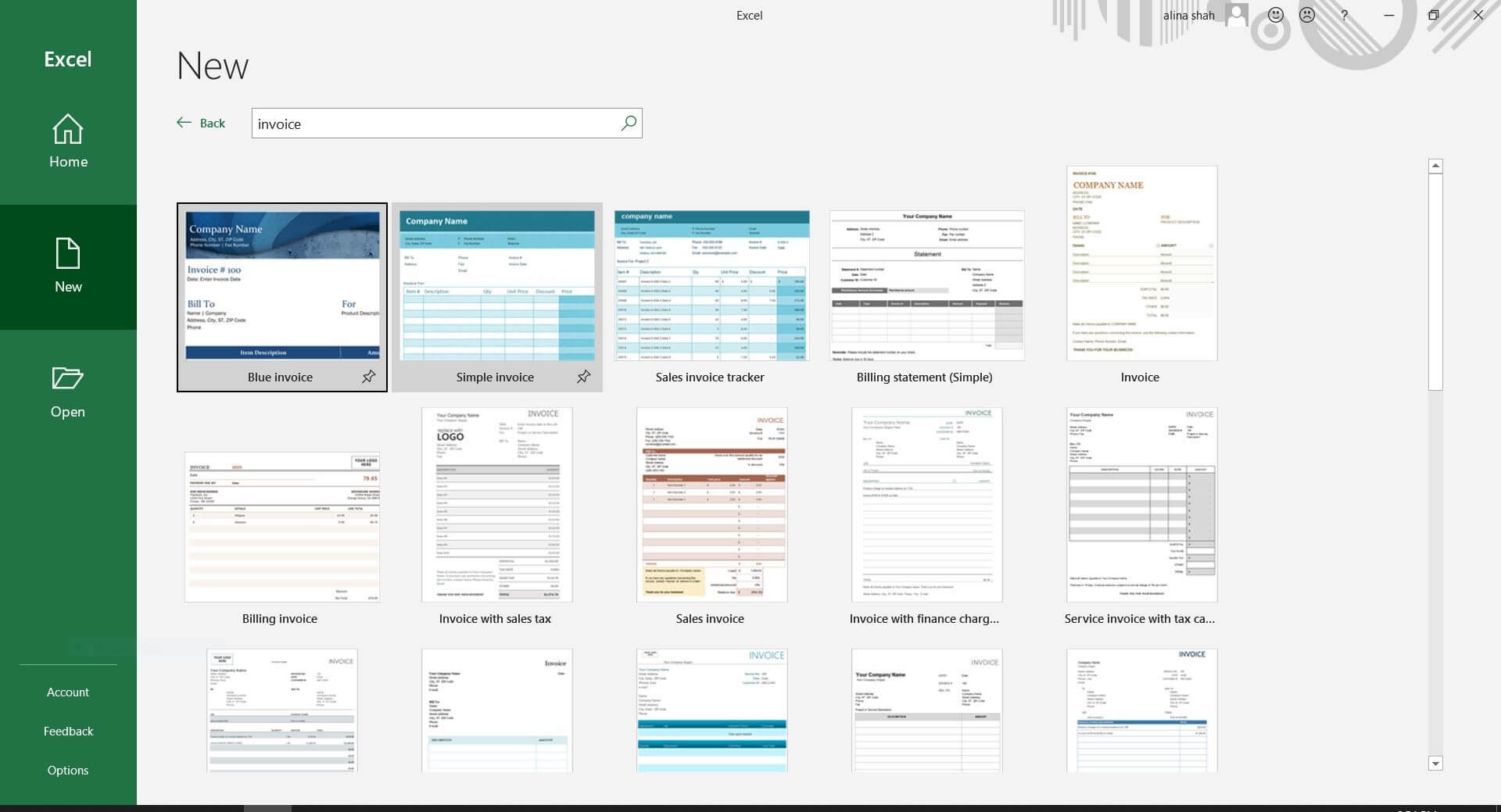

This Microsoft Excel template is a simple invoice. You get free basic invoices on Excel to edit and customize. These invoices are xlxs. File format.

Example 3

Microsoft Word also offers free simple invoice templates. These invoices will be in dox. file format.