A Beginner's Guide for Enterprise Risk Management

Edraw Content Team

Here is a beginner’s guide on the essentials of different risk management procedures and the various risk management frameworks that streamline on specific risk factors.

Main Types of Business Risks

Image Source: marketing91.com

Before we go on about the management of it, it is essential that we understand the risk. The thing about risks is that they are always a future potential, so you may have time in hand to act upon it and even prevent it. There can be tens of risk factors associated with a single endeavor, or one risk can shake many endeavors at once. Below are some of the primary business risks.

Credit & Financial Risk

Financial risks are the most relatable issues that apply to all kinds of enterprises and are all about the certainty of cash flow and unknown losses. It could mean various things, starting from debts or loans and not being able to pay for them, loss of profits, equity risks through the purchase of stocks, added costs, and having to bear any out-of-pocket expenses. You may find a client is not capable of paying back, or even cyber-threats may attack your valuable data and assets.

Strategic Risk

Strategic risks most significantly concern business endeavors that are bent on trying something new or out of the box, such as enterprises working with disruptive innovation, releasing new technology to the market, introducing or changing any business process, etc. It could also mean the failure of a business decision, the launch of new products or new service failing to bring in the expected profits, or marketing strategies failing to bring as much lead as expected. Otherwise, strategic risks also include established companies failing to adapt to new demands of the market. Overall, strategic risk is the situation when a business strategy fails to save the day.

Compliance Risk

Compliance risk is pretty straightforward that concerns all kinds of rules and regulations levied by the Government or other authorities, for the safety and security of consumers, workers, the environment, etc. This includes food safety regulations, building consent for new construction or renovation projects, chemical compliance for either producing chemical-based products or using large volumes of hazardous substances that include enterprises such as, paint manufacturers, pharmaceuticals and pest cleaning service providers among many others. The failure to comply with mandatory regulations may have consequences of having to pay fines, face legal prosecution or damaged reputation

Reputation Risk

For every business, reputation is the greatest asset. It is obvious that customers would choose a reputed brand over a company that may have bad reviews or ratings on its products or services, a nasty lawsuit, even poor customer support. Nowadays, with the rise of social media, brands are very vulnerable to reputation risks, with just about anyone having the power to leave a negative comment or review for the public to see. Many enterprises designate separate Online Reputation Management to respond instantaneously to such negative comments and resolve the matter then and there.

Operational Risk

Many people mistake operational risk with strategic risk, but there is a significant difference. The failure of a strategy doesn't mean that the company would stop operating. However, if a company is going through an operational crisis, it won’t be able to execute much of the business strategies smoothly. Operational risks may involve environmental damages, accidents or mishaps, labor strikes, technical and system outages, etc. While this is a primary concern for ERM, there is usually a back-up plan for several operational crises, given the fact that most of the operations can be done via hand-held and portable devices.

What is Enterprise Risk Management (ERM)?

Image Source: consider.biz

When one is planning to start a business, especially a startup, it will help compile necessary data to decide on the strategies to use as well as goals that would be set for one’s business.

ERM is a crucial part of Business Architecture, which is the compilation of all the methods, processes, and technology leveraged for identifying varying business risks and planning the possible ways to tackle the situation. One company may have several risk management frameworks based on ongoing situations, and this is a constant process that needs to keep evolving and adapting with the continuous changes in the industry.

Why is Enterprise Risk Management Important?

With a timely assessment, a risk management plan gives enterprises precision of methods and promptness to act upon, to decrease the immediate impact of a threat. It can only work with constant scrutinization, having an insight into the market, and learning from experiences of others, instead of merely assuming. Here are the key points that make Risk Management so crucial for enterprises.

The fundamentals of business, such as business process, technologies, market trends, product lines, all of it is a movement that is bent on changing, at inconstant paces and timelines. Although We cannot know what the future holds, we can presume the risks that may arise. So having a risk management framework in place does only give you the power to act on time.

Sometimes, knowing things is easy by learning from others, but the only experience brings you closer to elements that you didn’t know! That’s where lies the key to your redemption. To be able to chase the “things I don’t know,” enterprises can identify the emergence of a risk that may be invisible on the surface level.

Taking risks is a way of growth, and it has been the success behind many stalwarts and some of the most iconic products in the world. In this age of disruptive innovations, young entrepreneurs are ready to jump and take a stride. An outlook towards operational risks or strategic risks points out the importance of having a value chain of the enterprise, with an end-to-end approach that values both upstream and downstream relationships.

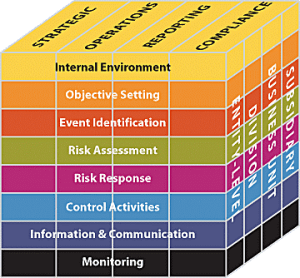

Core Components of Enterprise Risk Management Framework

The risk management process requires intuition and understanding of threats from diverse directions, which includes both the internal risks and external risks. For example, the health of your servers, the moral code of conduct, the strengths and shortcomings of your team belong to the former, while infused from the market, from cyberspace, from client reviews, or a new economic decision taken by the government belong to the latter… and sometimes even weather forecasts!

Assemble all these elements into an ERM Template and create a visual simulation to show where the enterprise stands at the moment and areas of vulnerability. Here are the core components that should go into your risk management framework.

- Assess the Work Culture of Your Enterprise - let’s say charity begins at home. As you aim to grow your business, you should have a clear discernment about the people and the infrastructure it all depends on. Monitor the risk appetite and risk tolerance that your workforce may have, and also how the seniors, mentors, and juniors can collaborate during a crisis or critical project.

- Take Events as a Learning Experience - because experience gives you the discernment to be able to distinguish whether a project or business decision is going to be a potential risk or opportunity.

- Constant Monitoring - even if you invest in ERM Technology, it is essential that you spend time scrutinizing what didn’t get captured in the automated data collection. Review product features, crosscheck publicity campaigns, research the market. These are key components to learn about your business and the world.

How Do You Implement Enterprise Risk Management?

If you follow the main components that go into a risk management framework, it will bring you to the next stage of implementing them strategically. Here is a guideline, as to how the necessary steps that go into the enterprise risk management process:

Define Core Values of the ERM

Look beyond the business plan, and the traditional metrics of investment like ROI, ROE, etc. look at other places like Share Price, Volatility of Market Prices, Capital Asset Pricing Model as well the kind of image you have in the social media and overall Online Reputation.

Understand the Diversities of Risk Assessment Frameworks and Standards

The fundamentals of risk management apply universally, and they are evolving at a fast pace. Sometimes the risk management frameworks and standards might not apply to new technologies and innovations. Having the knowledge and understanding of the new systems may give you the intuition to choose vital components so that your ERM initiative has a solid foundation.

Positive Persuasion

When you conduct the ERM policies for the betterment of your enterprise, you also need to make sure that you are on the same page with your organization. Use positive persuasion during the implementation of your ERM policies within the organization. Use soft skills, ERM Templates, group presentations, and create value for the organization.

Choose an Edraw Template to Fit your Needs

Diagrams are an essential medium through which ERM plans can be visualized to a team or managerial board that everyone can understand and relate to. ERM plan diagrams are created with dynamic use of graphics, images and pointers to make the whole thing more captivating and showcase all the tiny details included under a plan, with each element being under the spotlight, taking everything at face value.

Creating engrossing ERM diagrams can be the most straightforward job with the help of Edraw Diagramming Software. You can develop supplementary for Risk Assessment reports or visualize a new plan or business decision with the associated risks. You can use a vast collection of ready-to-use symbols, diagrams, signs, images, icons, and templates to make fully functional, dynamic plans with just simple drag-and-drop usability. The software is a one-time purchase, and you don’t have to renew or repurchase anything. Make your diagrams at lightning speed and have your presentations at a fast pace.

EdrawMax

All-in-One Diagram Software

- Superior file compatibility: Import and export drawings to various file formats, such as Visio

- Cross-platform supported (Windows, Mac, Linux, Web)